Does Mental Money Math Cause You Anxiety? this is my term Overanalyzing finances. Think about what bills you need to pay next and how much you need to deposit for each withdrawal. But taking it a step further… should I buy unsalted natural peanut butter for $3.99 even though the $11.99 unsalted natural almond butter is better for me? Is it really better for me? How long can I use this foundation without buying more? Is the cost of a round trip Uber ride and a group cocktail bill worth my hour? Where would I be, anyway, basically stressed all the time?

There was a time when I didn’t care about money. I just said yes. It also put me in so much debt that I couldn’t afford to put food on the table if I wanted to pay rent. Then I admitted to being more responsible with my finances. Yay me! Fast forward to becoming an entrepreneur and this awareness turns into hypervigilance.

I know I’m not the only one doing mental arithmetic. Yes, we need to pay attention to the inflow and outflow of funds. I learned this the hard way when I was in my 20s. But does it really need to make our brains and stomachs do backflips?

Why do you do mental arithmetic?

This is what really happened. Money equals security. When we don’t have enough, we feel insecure. Our amygdala starts firing up those fight, flight, freeze, comfort responses. We look for ways to make more money (struggle) Or save more money (flight). We spend time doing mental arithmetic, which may prevent us from doing anything (freeze). Or seek to direct our funds in a way that makes the people we care about happiest (appease).

But that’s the point. What exactly is enough? We find ourselves pursuing more and more without ever feeling satisfied or successful. Do you have this number in mind?

How do you feel about yourself when you have more or less? Do you equate your worth and worth with your financial status?

I’ll repeat the questions so you can take a few minutes to write down your answers. Give yourself the gift of reflection.

- What exactly is enough money?

- Do you have this number in mind?

- If so, what is it?

- If not, take some time to figure out that number.

- How do you feel about yourself when you have more or less?

- Do you equate your worth and worth with your financial status?

What money really tells us

Too often we choose to put our money in places that may not serve us. Then, when it comes time to invest in ourselves, the negative noise in our heads gives us every reason not to. We tell ourselves that the money could be used elsewhere, for other things and other people. We make new rules of “expensive and cheap” depending on the situation. It’s a new way to beat yourself up.

A few months ago, I was planning to buy myself a Nespresso coffee machine. I’ve been wanting one for at least three years (if not six). Then I found one of these on sale for $99. I read reviews, compared specs, listened to friends, and convinced myself I shouldn’t get it. Until one of my friends said, “I really wish you could do something for yourself.” Then I realized that my negative noise was winning.

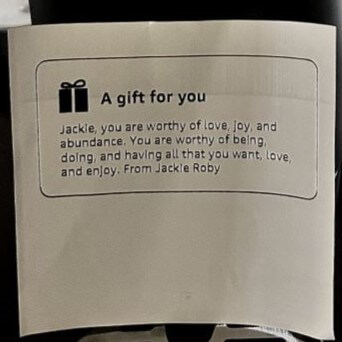

After some self-reflection, I chose my worth. It may seem small, but that’s the point. This noise affects us in everything big and small. So, to remind myself of this important choice, I wrote myself a gift note. I want to remember that I deserve to want things that are just for me. This is not selfish or guilty pleasure or profligacy. It’s just an investment in me because I’m worth it. Since then, I savor every sip of coffee and espresso with true joy. You say no to what you deserve?

Steps to Let Go of Mental Money Math

Here are some ways to help you stop doing mental math, create a sense of safety in your brain, and support you in making choices that are good for you.

- Step one: It’s time to buy you something! It doesn’t matter how much you spend. Pay attention to your process. You don’t need to change anything at this time. Just note (and write for extra credit):

- what you do

- How are you feeling emotionally?

- what’s on your mind

- Whether you buy it or not

- Step 2: Make a list of what you deserve.

- For example: Do you deserve to be happy? Do you deserve a breath of fresh air? Do you deserve respect at home?

- NOTE: If this is difficult, that’s normal. Take three deep breaths.

- Step 3: Imagine talking to a friend who is going through the same struggle.

- What advice would you give them about investing in themselves?

- What would you tell them if they couldn’t find something worthwhile?

- Step 4: If you know your human design, follow your authority.

- Step 5: Notice how you feel after taking these actions.

- Can you take a deep breath?

- Is your stomach settling?

- Does the decision feel less “life or death”?

- Is buying starting to feel fun? Or solve it easily?

Send me an email and tell me about your experience. you are not alone. Reach me at jackie@inspiredjourneyconsulting.com.

do not stop Believing

Money is fun. It’s a driving force in the way we live our lives—especially in the United States. It affects the career paths we choose, the people we spend time with, our romantic relationships, where we live and what we do when we’re not working. From cows, to metals, to paper, and now to virtual transactions, this concept has had a huge impact on how we view ourselves, others, and life. Somehow we allow this non-breathing thing to define us.

I find it deeply damaging how we allow negative stories about money to stop us from achieving our dreams. To say “money stops us” is to give power to an inanimate thing. It also has money as the enemy, which doesn’t make any sense. The real problem is that we close our minds to possibilities and allow negative noise to overtake us. But we can choose to silence this nonsense. What would it feel like to let go of “yes, but” and explore big, wonderful, wild dreams?

This is what I find interesting. That’s all I have. I help women and allies of color live the lives they want. (Here’s a secret—you don’t have to ruin your current life to do this.) Interested? Then This episode of the podcast Might resonate with you.

Remember, if nothing changes, nothing changes. You always have a choice. The question is whether what you are doing is serving you.